budget 2022 singapore gst voucher

Fast forward to 1 July 2022. Singapore Budget 2022 is aimed at bringing individuals and businesses forward ensuring that no one is left behind as Singapore charts a new way ahead said Ajay Kumar Sanganeria partner and head of tax KPMG in Singapore.

Heng Swee Keat About 950 000 Singaporean Hdb Households Will Receive Their Quarterly Gst Voucher U Save Rebate This Month This Is A Permanent Scheme To Help Those Living In Hdb Flats

15 hours agoThe assessable income threshold for GST vouchers will increase from S28000 to S34000 to cover more Singaporeans.

. 15 hours agoBudget 2022. 15 hours agoSingapore Budget 2022. GST hike higher income tax for top earners and CDC vouchers for all.

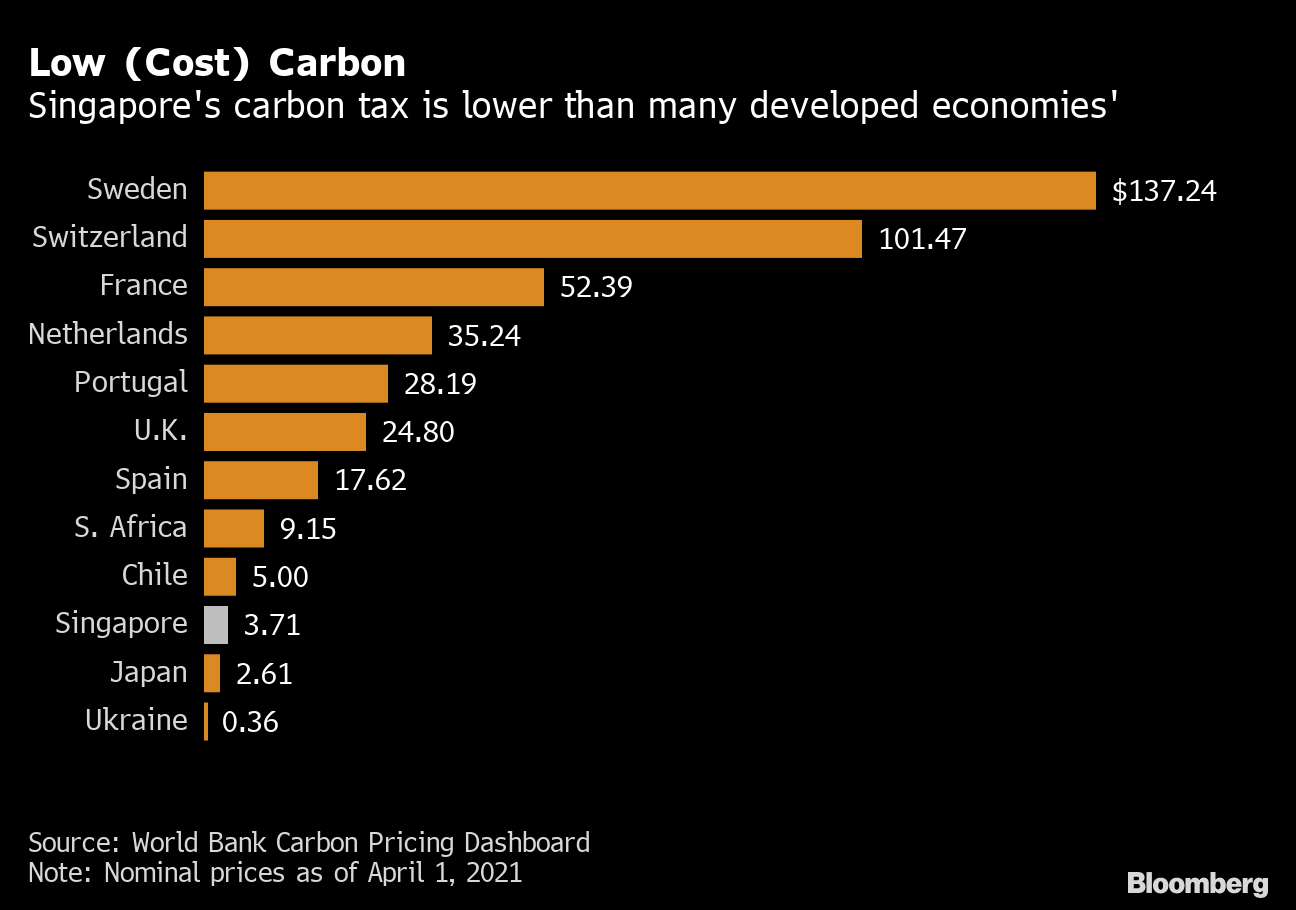

Since the previous Budget in 2021 the Government has announced its intention to increase the GST rate from the current 7 to 9 within the period of 2022 to 2024. The GST hike will be delayed for a year until 2023. 14 hours agoSingapores current carbon price of 5 per tonne will be in place until 2023.

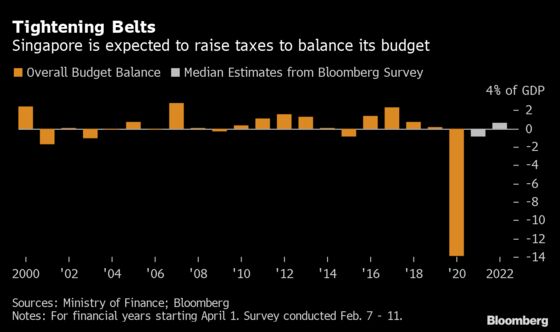

S6b to be drawn from past reserves for Covid-19 relief. GST will go up to 8 next year then 9 from 2024. 11 hours agoYet this mandatory tax forms a significant portion of Singapores yearly revenue.

The GST will further increase from 8 to 9 on Jan 1 2024. Singapores goods and services tax GST will be raised and staggered out in two steps. 9 things you need to know about Budget 2022 People wearing protective face masks in Orchard in Singapore on Jan 5 2022.

15 hours agoThe GST voucher scheme which is a permanent scheme in Singapore will have its Assessable Income threshold for GST vouchers increased from S28000 to S34000 to cover more Singaporeans. Singapore to raise GST from 7 to 9 in two stages in 2023 and 2024. The most anticipated part of every Budget speech is the GST voucher and U-Save rebate announcement.

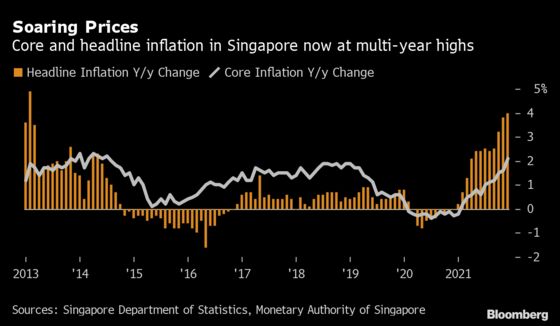

13 hours agoFrom a GST hike to CDC vouchers. Also from August this year if your assessable annual income is up to S34k previously S28k youll now be eligible for the GST voucher cash payouts. 13 hours agoFeb 18 2022 655pm Singapore time Despite the bite of inflation Singapores government will continue spending to ease the pain with higher taxes coming to offset the cost.

Not to mention the rising costs of living. First to 25 in 2024 and 2025 and 45 in 2026 and 2027 before reaching 50. 12 hours agoAs Mr Lawrence Wong said during the Singapore Budget 2022 therell be an increase in GST heres how to offset with vouchers and rebates.

The carbon tax will be raised in stages. 16 hours agoEligible HDB households will receive double their regular GST Voucher - U-Save in April July and October. GST hike higher income tax for top earners and CDC vouchers for all More On This Topic Assurance Package increased to 66 billion GST voucher scheme beefed.

This years two-hour-long budget speech given by Finance Minister Lawrence Wong today in Parliament addressed plans to delay a hike to the GST and packages. What Is The GST Voucher Scheme. 14 hours agoBudget 2022 highlights.

7 To 9 Over 2 Years. SINGAPORE The 2022 Budget statement will be delivered by Finance Minister Lawrence Wong in Parliament on Feb 18 at 330pm. Those with homes with annual values up to S13k will get cash payouts of S500 by 2023.

15 hours agoEligible seniors will also receive a special GST Voucher - Cash Seniors Bonus of between S600 to S900 disbursed over 3 years from 2023 to 2025. S400 vouchers S200 each in 2023 and 2024 for all Singaporean households. SEE ALSO Budget 2022.

GST increase to be staggered over 2 years starting from Jan 2023 SINGAPORE The Goods and Services Tax GST will be increased progressively rising to 8 per cent with effect from Jan 1 2023 and going. Read next - Budget 2022 highlights. There will be a GST hike from 7 to 8 on 1 Jan 2023.

Singapore to progressively raise. Households to get more rebates 100 CDC. 15 hours agoBudget 2022.

Those residing in homes with annual values of below S13000 will see cash payouts increase from S300 to S500 by 2023. New Household Support Package. GST Vouchers and U-Save Rebates for Eligible Households.

During this years Budget 2022 we collectively heaved a sigh of relief as it is announced that. Ah weve saved your favourite for the last. For example there is the upcoming planned GST hike in Budget 2022 as Singapores economy is recovering from COVID-19.

From 7 per cent. 12 hours agoRead on to find out seven important stats and figures that Budget 2022 has in-store for people in Singapore. After service charge and a seven per cent goods and services tax GST the total cost comes up to S84 in two hours.

Cushioning the impact of. Assurance Package increased to 66 billion GST voucher scheme beefed up to offset GST hike The GST rate will increase from 7 to 9 per cent in two stages - one percentage point each. 9 hours agoBudget 2022.

The permanent GST Voucher scheme was first introduced back in Budget 2012 as a way to help lower-income Singaporeans cope with GST hikes. 14 hours agoThe permanent GST Voucher scheme is also to be enhanced with a higher income threshold for the cash payouts and a larger quantum of up to S500. GST hike higher income tax for.

Announced in 2020. Singapore to raise GST from 7 to 9 in two stages in 2023 and 2024. Extra S640 million to cushion impact.

Singapore Moves To Ease Public Concern Over Impending Tax Hike Bloomberg

What To Expect From Singapore S Budget From Tax Hikes To Business Relief

Property Tax Singapore 2022 Increase Majority Of Hdb Flat Owners Will Pay More Property Tax Next Year